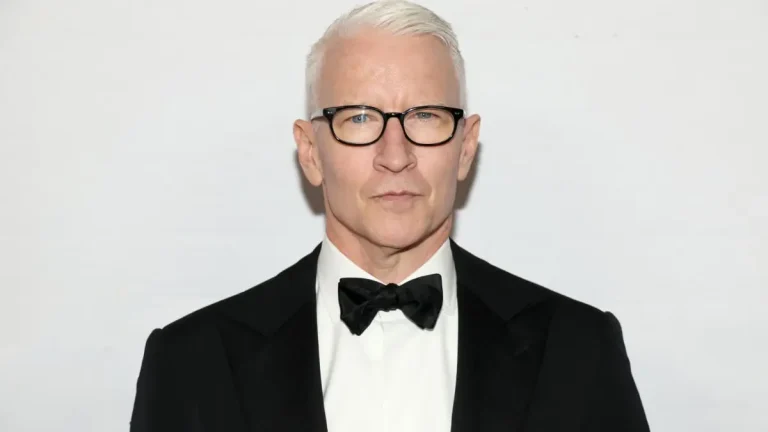

Anderson Cooper isn’t just another celebrity with a classic surname.He’s a top journalist, a bestselling author, and a recognizable face in American media.But people aren’t only tuning in to see him on CNN.They’re Googling a specific question: how much money did Anderson Cooper inherit from his mother? A lot of this curiosity comes from the …

Anderson Cooper’s Inheritance What Did He Actually Receive

Anderson Cooper isn’t just another celebrity with a classic surname.

He’s a top journalist, a bestselling author, and a recognizable face in American media.

But people aren’t only tuning in to see him on CNN.

They’re Googling a specific question: how much money did Anderson Cooper inherit from his mother?

A lot of this curiosity comes from the myth of the Vanderbilt fortune—the mansions, the yachts, the high society drama.

So when the truth about Cooper’s modest inheritance broke out, jaws dropped.

We’re diving into that number, but there’s way more going on under the surface.

This isn’t just about dollars.

It’s about how legacy, reputation, and values collide when it comes to inheritance in high-profile families.

If you want more than just typical celebrity net worth gossip, you’re in the right place.

We’re unpacking Anderson Cooper’s inheritance, the decline of one of America’s wealthiest families, and the mindset behind walking away from dynastic riches.

Anderson Cooper’s Inheritance Overview

It wasn’t billions.

Not even tens of millions.

When Gloria Vanderbilt passed away in 2019, she left her son Anderson a surprising total: $1.5 million.

Let’s be real—that’s a lot for most people.

But when it comes from a family name as loaded as Vanderbilt?

That number sends shockwaves.

This bit of inheritance news grabbed attention fast.

Especially since Anderson is the direct descendant of Cornelius Vanderbilt, a legend who built a fortune estimated at over $200 billion in today’s terms.

The rest of Gloria’s estate?

Not much left.

Her Manhattan apartment went to another son, and by the time probate played out, her financial castle had already crumbled.

Public docs confirmed there were no secret trusts or hidden millions.

That choice was telling.

Everything was accessible, traceable.

There wasn’t a gold mine waiting in some offshore account.

Now, zooming out:

- Anderson could’ve coasted on inherited money, but chose building his own worth

- The $1.5M inheritance looks tiny next to the Gilded Age Vanderbilt glory days

- This all sparked debates around modern celebrity finance vs old money identities

The number didn’t just make headlines—it forced a reckoning about how America sees “rich families.”

Why Anderson Cooper’s Inheritance Surprised The Public

For decades, the Vanderbilt name meant one thing: generational power.

So for many folks, reading that their most famous descendant got less than a fraction of the usual celebrity windfall was a shock.

And it’s not just the number that made waves.

It’s what it stood for.

There’s a psychological twist here.

You’ve got this dynasty—once the rulers of railroads, ships, and America’s elite social circle—and now, just one generation down, there’s barely enough left to call a legacy.

People expected private jets and fifty-room mansions.

Instead, Cooper got what some would call a strong middle-class inheritance—by celebrity standards anyway.

What made this even more interesting?

Anderson didn’t complain.

Didn’t chase more.

Didn’t leverage it into a reality show.

Instead, he leaned harder into his philosophy: inheritance isn’t the path to purpose.

Here’s how it breaks the mold of celebrity wealth:

| Public Expectation | Cooper’s Reality |

|---|---|

| Multi-million-dollar trust fund | $1.5M one-time inheritance |

| Lavish estate shielded by privacy tools | Probate records fully public |

| Financial ease via family lineage | Years of reporting grind, night shifts, and solo career climbs |

So when you break down the reactions—disbelief, curiosity, respect—it all makes sense.

This wasn’t about the money itself.

It was about how someone raised in the shadow of unimaginable wealth decided to carve his own path without it.

The Decline Of Vanderbilt Family Wealth

Before Cooper stepped into TV studios and presidential debate panels, his ancestors built one of the most notorious fortunes in U.S. history.

At its peak?

Vanderbilt money wasn’t just big.

It was monster-level.

Cornelius Vanderbilt—aka “The Commodore”—wrecked the competition in 19th-century shipping and railroads.

His son William pumped it even higher, turning empire into empire-on-steroids.

The family stashed wealth in Newport palaces, Fifth Avenue castles, and relentless high-society moves.

But here’s what no one teaches about dynasties:

they crumble when the strategy dies.

As generations passed, Vanderbilt descendants lived it up but didn’t secure the foundations.

By the time Gloria inherited her slice, most of it had already gone sideways.

She got $4.2 million at 21.

Equivalent to over $50 million today—not bad.

But even that faded fast.

Investments didn’t stick.

Divorces drained.

Legal missteps burned.

And lifestyle inflation?

Relentless.

While Gloria did create a signature fashion line in the ’80s—those famous jeans were a hit—it didn’t last forever.

Add in the curveballs:

- Trusted advisors accused of embezzlement

- Real estate sales instead of asset growth

- Liquidating properties to cover mounting expenses

Her final estate was what it was: smaller than anyone expected.

For anyone wondering how multi-billion-dollar families lose it all?

This is textbook.

Wrap it all up and you get one harsh reality:

The Vanderbilt name doesn’t carry money anymore.

Anderson Cooper knew that for years.

Which is why he never waited for someone to write him a check.

Anderson Cooper’s Own Financial Journey and Net Worth

Anderson Cooper as a Self-Made Millionaire

People often assume Anderson Cooper’s wealth is thanks to his famous family name. But how much money did Anderson Cooper inherit from his mother? Just $1.5 million. For someone from the Vanderbilt line, that’s pocket change. The bulk of his wealth—around $200 million—didn’t come from inheritance. It came from hard work.

As CNN’s biggest star, Cooper earns an estimated $20 million a year. Aside from hosting Anderson Cooper 360°, he racks up additional paydays from his work on CBS’s 60 Minutes and the network’s annual New Year’s Eve specials. His long-standing presence in prime-time and special event TV explains why so much of his fortune is tied to career earnings—not family money.

Even before all the fame, Cooper was hustling. He launched his journalism path as a fact-checker at Channel One News and traveled solo to war zones with a borrowed camera. That fearless approach got him noticed. It’s the kind of hands-dirty ethic that shapes a genuine self-made millionaire.

Media Ventures and Real Estate Investments

Not all of Cooper’s wealth is tied directly to TV. He’s diversified. He’s written bestsellers like Vanderbilt: The Rise and Fall of an American Dynasty—a deep dive into his family’s complex financial saga. Podcasts, documentaries, and speaking engagements also keep the revenue flowing.

On the asset side, Cooper owns a string of prime real estate that works as both investment and lifestyle upgrade. Properties include:

- A $20 million mansion in the heart of Connecticut

- An $8 million New York City apartment

- A converted West Village firehouse

Toss in a Gulfstream jet and a sleek 50-foot yacht and you get a clear sense that Cooper isn’t just sitting on a salary. He’s playing the long game with smart asset diversification. These kinds of investments tell their own success story, one built not on inheritance, but personal strategy.

Comparison of “Self-Made” Wealth vs. Inheritance

So how does Cooper define wealth? Very differently from how his family once did. He’s been transparent about not wanting to rely on inherited fortune. He doesn’t believe in the idea of just passing huge sums down and hoping for the best.

He’s called inheritance a “curse” that stunts personal growth. For him, the Vanderbilt dynasty serves more as a cautionary tale—a family that burned through billions rather than built something new with it. That outlook shaped his decision to build an independent path from the start.

It’s no accident you rarely hear him brag about family legacy. Cooper’s determined to write a different story where discipline, media savvy, and hustle take center stage. The $1.5 million inheritance from Gloria Vanderbilt? Just a footnote.

Clarifying Anderson’s Reported Net Worth

There’s still confusion out there. Some outlets peg Cooper’s net worth as low as $60 million. Others say it’s closer to $200 million. Who’s right? Probably the higher estimate.

The $60 million figure typically recycles older earnings data or omits his broader asset base—real estate, book deals, media licensing rights. When you factor in long-term CNN contracts, production deals, and years at the top of the media food chain, $200 million makes more sense.

Celebrity net worth numbers often swing wildly based on incomplete info. Cooper’s financials are also less murky because they’re not shielded by the kind of trusts many celebrities use. That means what you see is closer to reality—and closer to the kind of transparent story he prefers to tell.

Philosophical Views: Anderson Cooper on Inheritance

Rejection of Inherited Wealth

Some people dream of windfalls from family fortunes. Not Anderson Cooper. He’s been clear: inherited wealth isn’t something he admires—it’s something he avoids. When asked about how much money he inherited from his mother, the modest figure of $1.5 million wasn’t a disappointment. It was a validation.

The idea that inheritance is a “curse” wasn’t hatched overnight. Cooper’s father, Wyatt Cooper, planted the seed. Wyatt believed money given without effort robs kids of purpose. Anderson took it to heart. It also didn’t help that Gloria Vanderbilt—despite building a $100 million business with her famous jeans—ended up borrowing money from her son in later years.

Watching his mother go through legal issues, multiple divorces, and financial instability only strengthened his belief that inherited wealth can be more trouble than it’s worth. It clouds decisions, attracts the wrong people, and makes it harder to carve your own identity.

Personal Values on Raising the Next Generation

Now that he’s raising his own sons, Cooper’s putting those beliefs into action. He’s said he’ll fund their education—but beyond that, they’ll need to earn their way. This isn’t just a performative line. It’s a way of ensuring they never feel the drag of entitlement.

What does that look like in real life? It means teaching discipline, grit, and showing that success is earned, not handed down. Cooper seems more interested in passing along those values than a bank balance.

The modern parenting message here is straightforward: legacy isn’t about leaving incubated wealth. It’s about building character and self-belief. For Cooper, that’s the real family treasure.

Role Models and Broader Comparisons in Celebrity Finance

In the celebrity world, Cooper isn’t alone in this approach. Bill Gates and Warren Buffett have famously pledged to give away most of their fortunes, believing their kids are better off earning their own place in the world.

On the flip side, not everyone agrees. Paris Hilton built her brand on inherited wealth and luxury. That path works for some—but it’s not one Cooper wants any part of.

This split in views reflects a deeper conversation around what wealth should do. Build freedom? Sure. But only if it’s paired with responsibility and drive. Cooper’s philosophy has gained attention because it contrasts sharply with old money mindsets.

The takeaway? He’s found a way to reshape family legacy on his own terms—using media impact and personal ethics over bank statements passed down from a gilded age.

Celebrity Family Wealth and Legacy Dynamics

Think about this: If you were born into a famous family with millions in the bank, would you ever worry about making your own money? Most people assume celebrity kids are set for life, but the truth is—it’s not that simple. “How much money did Anderson Cooper inherit from his mother?” That kind of question is the tip of the iceberg. Let’s peel back the curtain on how money really moves from one famous generation to the next.

Patterns of Inheritance in Celebrity Families

It’s easy to assume celebrity wealth gets handed down in neat, fat checks. But Hollywood legacy doesn’t always mean cash in the bank. Dynastic families like the Rockefellers, Hearsts, and yes, the Vanderbilts often relied on tightly constructed trusts. These legal setups shield assets, lower tax hits, and keep public eyes out of private matters.

Contrast that with modern celebrities. Plenty of them are choosing something different: strategic giving, controlled access, or even zero inheritance. Take Ashton Kutcher, who’s made it public he won’t just hand his kids money—they’ll earn their way. It’s a noticeable shift from older family dynasties that distributed wealth automatically.

Today, most celebrity families use these common tools to manage legacy and keep control:

- Irrevocable trusts: Keeps wealth tied up for specific uses like education or home buying, not wild spending.

- Family LLCs or foundations: Empower the next generation to give back or grow wealth while staying hands-off.

- Non-disclosure agreements & estate privacy clauses: Keeps the structure and size of inheritance out of tabloids.

Challenges of Sustaining Multigenerational Wealth

But here’s the hard truth—most generational wealth doesn’t last. The Williams Group found that 70% of wealthy families lose their fortune by the second generation. That stat breaks even harder by the third. What goes wrong? It’s not always greed. Sometimes it’s just bad planning, no money education, or lifestyles that outpace income.

Look at the Vanderbilts. Cornelius built an empire in shipping and railroads. His son doubled the wealth. By the time it hit Gloria Vanderbilt, trust funds were slim. And at her death, what did Anderson Cooper inherit? Just $1.5 million. That’s not pocket change to most, but for the Vanderbilt name, it’s pennies. Her financial downfall? Four divorces, legal mishaps, and lavish living without estate protection.

So here’s the caution flag for anyone planning to pass wealth:

- No financial literacy = fast exit ramp to broke.

- Legal blind spots invite fraud and embezzlement.

- Over-consuming without assets producing.

Anderson Cooper essentially had a front row seat to his family fortune fading out—and he learned.

Modern Celebrity Wealth Management Strategies

So, what are today’s A-listers doing differently? First: spreading their wealth across industries. They don’t lean on fame alone. Take someone like Dwayne Johnson—he’s got tequila, production companies, fitness brands. Rihanna? Fashion, beauty, music. Oprah? Everything from cable networks to book clubs printing cash.

There’s also a bigger focus on impact giving. It’s not just about passing down money. MacKenzie Scott, post-divorce from Jeff Bezos, has dropped over $14 billion in donations. That’s a legacy strategy — she’s writing her values into her bank transfers. Beyoncé and Jay-Z’s use of trusts shows precision wealth planning. Their estate is built like a fortress.

Cooper’s choices also reflect this modern playbook. Yes, he inherited once—but his $200 million worth came from hustle. From anchoring CNN, to authoring bestsellers, to investing in real estate. The guy’s got a $20 million estate in the Hamptons, a penthouse in NYC, and even a refurbished firehouse.

So why did he say inheritance is a “curse”? Because financial comfort without purpose defeats drive. He’s choosing to pass down values, not just assets.

Anderson Cooper’s Legacy Beyond Wealth

Personal Legacy vs. Financial Wealth

It’s one thing to ask, “How much money did Anderson Cooper inherit from his mother?” It’s another to ask—does that number even matter? To Cooper, the answer’s pretty clear. He grew up around wealth, tuxedos, and champagne-soaked evenings, sure. But money never defined him.

His father, Wyatt Cooper, warned him early—don’t expect a trust fund. His mom, Gloria Vanderbilt, symbolized beauty and wealth, but by the end, she was asking her son for loans. Watching his family fortune collapse gave him a front-row view of how not to do money. Today, Cooper’s building something else: personal legacy.

And he’s passing on more than just dollar signs to his own kids. His plan? Cover their education, then cut the financial cord. Not out of punishment, but to spark purpose. To Cooper, self-sufficiency is the inheritance.

Key Takeaways for the Audience

So what do we really learn from Cooper’s story?

- Legacies with no financial literacy crumble.

- Privilege alone doesn’t buy persistence.

- Freedom comes from earning, not collecting.

Cooper didn’t ride the Vanderbilt coattails. He had one foot in generational glory and the other in breaking news, building his career headline by headline. That’s something everyday readers can take to the bank. Whether you’re passing down wealth, building from zero, or somewhere in between—it’s not just about protecting cash.

It’s about living values you stand behind. Teaching independence. And putting legacy into the stuff that outlasts bank balances.

Cooper’s journey lights the path for anyone with a family name, a desire to break cycles, or a hunger to build instead of inherit. And no matter how many zeros are in your account? That mindset is priceless.